Budgeting can help businesses make wise financial decisions by reducing overspending, making sure daily operations are sufficiently funded, and effectively allocating resources. It can also show the company where its financial peaks and troughs are and prepare the business for different financial situations. Budgets are geared toward fixed monetary targets, whereas forecasts allow for greater flexibility in adapting to unexpected events or market shifts. Businesses will have to keep updating forecasts as the world changes, but there will always be some risk that the forecasts are not accurate. Furthermore, forecasting that is biased toward using past data can lead to overly positive predictions, particularly if market conditions change suddenly.

Advantages of Standard Costing:-

In fact, these comparisons are so useful that many companies track the numbers side by side for instant results. Imagine a company is expecting to pay $1,000 as the standard cost for a certain material but when it actually buys the material, it only pays $900. If it sees that difference immediately, it knows its profits are likely to be higher than usual. Similarly, if a company uses $20,000 as a standard figure for monthly labour expenses but then incurs $25,000 in payroll costs, the accounting records immediately note that 25% increase. Fixed overhead is allocated to the cost of the product based on the number of labor hours used at the standard rate of 2.60 per labor hour.

Flex Budgeting

Every budget often includes a total of all you hope to spend in a given period and how you intend to meet these expenditures. This article defines, explains, and states the difference between a budget and a standard. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of taxation of rsus explained experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Budgeting Helps You Stay out of Debt

Standards are used as the basis of comparison with actual costs or volumes in variance analysis. For example, in a manufacturing entity, a standard will be set for the per unit direct materials cost, per unit direct labor cost and per unit overhead cost for each individual product the entity manufactures. A budget is a statement of estimated incomes and expenses over a specific time period.

Do you own a business?

Using updated budgets and forecasts, companies can plan for the worst while hoping for the best. They can cut costs, find new investments, and insure or hedge against risk, and so remain nimble and in good financial shape in the event of an unforeseen problem. Causal forecasting examines the relationships between different variables to predict financial outcomes. For example, a company might use causal forecasting to analyze how external factors such as economic growth, inflation rates, or customer behavior impact sales.

While a budget refers to a forecasted list of future income and expenditures, a standard is a benchmark that determines what cost the company cannot exceed and what amount of output is considered fundamental. This is also used to mean the desired cost that will be used up in the manufacture of a product. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Management attention is then drawn to any unfavorable variances for investigating into the causes and taking the corrective actions to control costs. Budgeting and forecasting are strategic processes that help management set a course for resource allocation, whether that’s for day-to-day expenditure, marketing spending, or investment in growth. The forecast, meanwhile, provides a live picture of how those allocations are holding up.

The procedure is also repeated with output to ensure that production is equal to the standard. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Finance Strategists has an advertising relationship with some of the companies included on this website.

- Think of zero-based budgeting as a ‘fresh start’ at the beginning of a new budgeting period.

- A budget generally refers to a department’s or a company’s probable revenues, costs, or expenses.

- This standard rate is a function of the expected fixed overhead and the expected volume of production.

- Budgeting gives a framework for budgeting resources; forecasting makes it a bit more adaptive by generating continuous projections to support in-between-year decisions.

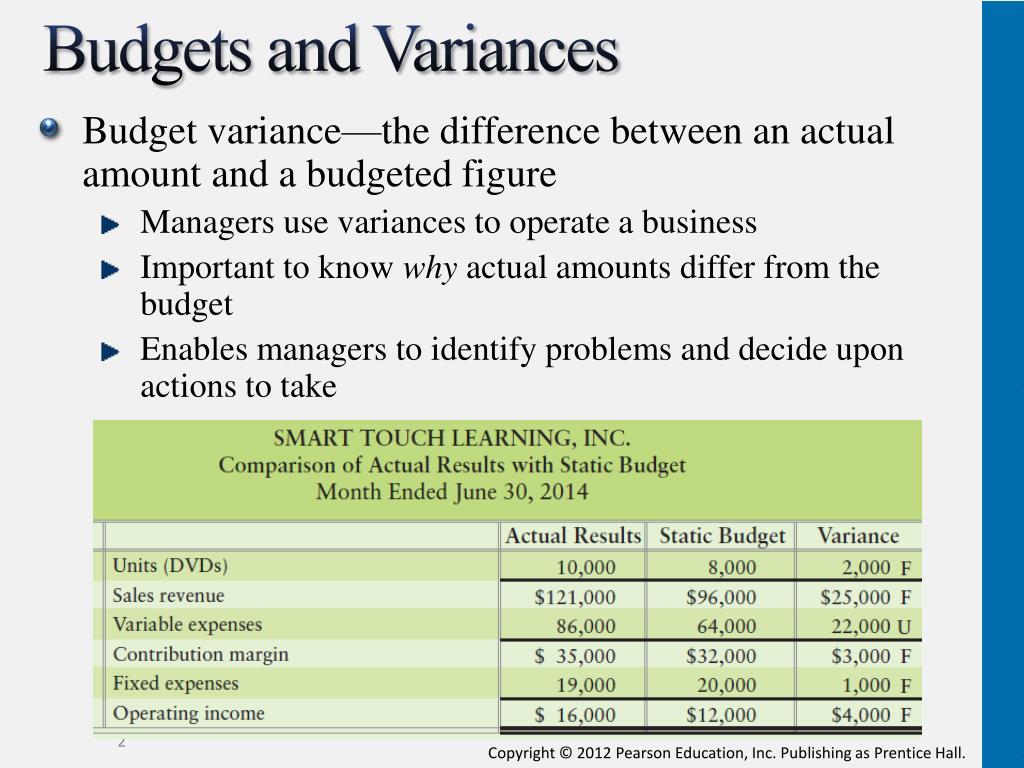

- The variance is the difference between the standard units and the actual units used in production, multiplied by the standard price per unit.

Rolling budgeting is a continuous process where budgets are updated regularly, mostly every quarter. It allows companies to adjust their financial plans based on recent performance and changes in the business environment. It also offers flexibility and ensures that the budget remains relevant throughout the year. Budgeting and forecasting are both important tools for planning finances in the company.

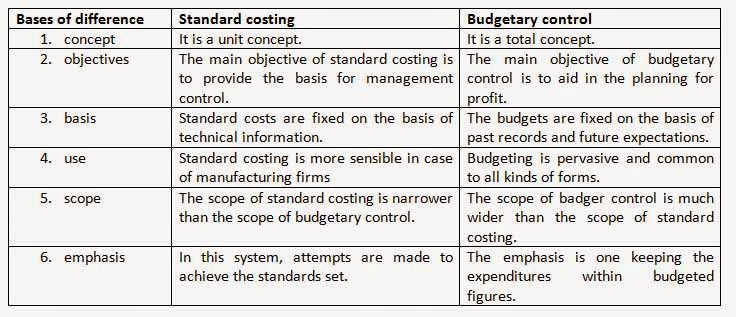

Budgetary control is a comprehensive approach to financial management, providing organizations with the tools needed for accurate financial planning, monitoring, and control. Variance analysis is the process of breaking down the difference between standard (budget) and actual costs to explain whether differences in price, quantity or both caused the business not to perform to expectations. Minimizing costs and maximizing sales are two prime management aspects that commercial entities need to focus on for maximizing their profits. The control and management of cost is, therefore, one of the chief functions for all commercial entity.